What is Market Trends: Bearish & Bullish Trend in Forex Market

Contents:

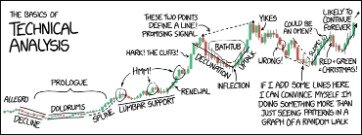

The price always moves near its average value but can deviate in one direction or another. In the case of a flat market, a support line is drawn at the lows and a resistance line at the highs. If the movement is upward, a support line is drawn at the chart lows. Technical analysis considers statistics related to the market activity of the stock–buys and sells.

The strengths of their work are that they introduced GA to optimize the ANN. First, the amount of input features and processing elements in the hidden layer are 12 and not adjustable. Another limitation is in the learning process of ANN, and the authors only focused on two factors in optimization. While they still believed that GA has great potential for feature discretization optimization.

Since our proposed solution is also focusing on short-term stock price trend prediction, this work is heuristic for our system design. Meanwhile, by comparing with the popular trading strategies from investors, their work inspired us to compare the strategies used by investors with techniques used by researchers. Hafezi et al. in built a bat-neural network multi-agent system (BN-NMAS) to predict stock price. They also applied the Bat algorithm for optimizing neural network weights. The authors illustrated their overall structure and logic of system design in clear flowcharts. While there were very few previous works that had performed on DAX data, it would be difficult to recognize if the model they proposed still has the generality if migrated on other datasets.

Trading Cards Market Size 2023, Share, Price, Trends, Analysis … – Digital Journal

Trading Cards Market Size 2023, Share, Price, Trends, Analysis ….

Posted: Tue, 11 Apr 2023 07:00:00 GMT [source]

For example, it is hard to find the exact accuracy number of price trend prediction in most of the related works since the authors prefer to show the gain rate of simulated investment. Besides the different result structure, the datasets that previous works researched on are also different from our work. Some of the previous works involve news data to perform sentiment analysis and exploit the SE part as another system component to support their prediction model. Atsalakis and Valavanis in proposed a solution of a neuro-fuzzy system, which is composed of controller named as Adaptive Neuro Fuzzy Inference System , to achieve short-term stock price trend prediction. Not only did they compare their proposed system with the popular data models, but also compared with investment strategies. While the weakness that we found from their proposed solution is that their solution architecture is lack of optimization part, which might limit their model performance.

Filtering the Market Using Technical Analysis

The stock market trend analysis stock analysis method involves the evaluation of a business at a basic financial level. Investors use fundamental analysis to determine whether the current price of a company’s stock reflects the future value of the company. Stock analysis helps traders to gain an insight into the economy, stock market, or securities. It involves studying the past and present market data and creating a methodology to choose appropriate stocks for trading. Stock analysis also includes the identification of ways of entry into and exit from the investments.

Pharmaceutical Solvents Market Analysis, Trend, Future Scope … – Digital Journal

Pharmaceutical Solvents Market Analysis, Trend, Future Scope ….

Posted: Mon, 17 Apr 2023 10:18:35 GMT [source]

Another method is to run RFE for each individual stock and calculate the most effective features by voting. In the implementation part, we expanded 20 features into 54 features, while we retain 30 features that are the most effective. In this section, we discuss the evaluation of feature selection.

For example, changes in a similar industry or the creation of a new governmental regulation would qualify as forces impacting the market. Analysts then take this data and attempt to predict the direction the market will take moving forward. In Q3 2022, the share of renewables managed to increase its share to 49%.

Experiment with various https://trading-market.org/ to discover the ones that work best for your particular style of trading, and as applied to the specific stocks that you trade. You’ll likely find that some indicators work very well for you in forecasting price movement for some stocks but not for others. On the flip side, if the 50-day moving average crosses from above to below the 200-day moving average, this is referred to by analysts as a “death cross”.

Even though the market is prone to sudden knee-jerk reactions, hints usually develop before significant moves. A technician will refer to periods of accumulation as evidence of an impending advance and periods of distribution as evidence of an impending decline. There are typically three time frames used when analyzing stock price trends. Indicators that measure the momentum of a stock including overbought and oversold conditions are momentum indicators. Basic momentum indicators come pre-programmed in most charting/trading platforms. These indicators help traders to better time their entries and exits.

You don’t need an economics degree to analyze a market index chart. It does not matter whether you are looking at a stock, market index or commodity. The technical principles of support, resistance, trend, trading range and other aspects can be applied to any chart. As simple as this may sound, technical analysis is far from easy.

In other words, a sideways trend, or flat, on Forex is manifested in the price chart as highs and lows located sequentially at approximately the same level. When the movement is downward, a resistance line is drawn at the price highs, and support is drawn parallel to it. The increases in both of these technical indicators may present a signal to buy the stock.

Gas and electricity market reports

The broad trend is up, but it’s also interspersed with trading ranges. In between the trading ranges are smaller uptrends within the larger uptrend. The uptrend is renewed when the stock breaks above the trading range. A downtrend begins when the stock breaks below the low of the previous trading range. Technical analysis has to do with forecasting future financial price movements based on past price movements.

Momentum oscillators are constructed from price data, but they are calculated so that they fluctuate between a low and a high, typically between 0 and 100. Some examples of momentum oscillators include rate of change oscillators, the relative strength index , stochastic oscillators, and the MACD (moving-average convergence/divergence oscillator). Relative strength analysis is based on the ratio of the prices of a security and a benchmark and is used to compare the performance of one asset with the performance of another asset.

First Red Day

Renewable generation improved its output by 1% (+3 TWh) year-on-year. This was the result of an increase of 28% in solar generation (+16 TWh) and 7% of onshore wind (+4 TWh). Reduced output levels of nuclear (-41 TWh) and hydro generation (-17 TWh) allowed fossil fuel generation to increase by 11% (+24 TWh) year-on-year, despite high energy commodity prices. The Chart of the Day belongs to the oil and gas E&P company Vista Energy . Barchart is a leading provider of market data and services to the global financial, media, and commodity industries.

It was also used to determine the structure of the Wavelet Neural Network. The dataset of this work consists of five well-known stock market indices, i.e., SSE Composite Index , CSI 300 Index , All Ordinaries Index , Nikkei 225 Index , and Dow Jones Index . Evaluation of the model was based on different stock market indices, and the result was convincing with generality. By using Rough Set for optimizing the feature dimension before processing reduces the computational complexity. However, the author only stressed the parameter adjustment in the discussion part but did not specify the weakness of the model itself. Meanwhile, we also found that the evaluations were performed on indices, the same model may not have the same performance if applied on a specific stock.

Trend analysis tries to predict a trend, such as a bull market run, and then ride that trend until data suggests a trend reversal, such as a bull-to-bear market. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Make Stock Trends your go-to investment analysis resource every week!

This could be decreasing volume, a large panic, a crack of a trend line, or price holding under VWAP. When growing a small account, capitalizing on sector momentum is key. The hype creates a tailwind for other stocks in the hot sector to trend higher. I’m going to share my experience and to speak about common mistakes of beginner traders. I hope this read will provide you with a deeper understanding of what a trend is, how to work with it and what market entry and exit points are. The most commonly used tool is trend line since it allows discovering channels within which price keeps moving.

- Basic types of indicators include price-based indicators, momentum oscillators, and sentiment indicators.

- The primary strength of this work is that the authors used the latest deep learning technique to perform predictions.

- If the data is incomplete, inaccurate, or otherwise flawed, the analysis may be misleading or inaccurate.

But even if you trade mid-term, knowledge about the current long-term trend can help you compare data obtained from different timeframes. Besides, it comes into play when you work with multiple analytical tools and need to align the information and make decisions within shorter periods. Significant events and the global economy can impact the asset price at any moment, but long-term price movement usually prevails despite what happens on the market.

To draw a downtrend line, a technician draws a line connecting the highs on the price chart. These include relative strength analysis, trend, consolidation, support, resistance, and change in polarity. Other stocks tend to experience more volatility on a regular basis, with price making sharp moves up or down even in the midst of a general long-term trend.

Meat Substitute Market Size, Industry Trends, Application Scope … – Digital Journal

Meat Substitute Market Size, Industry Trends, Application Scope ….

Posted: Mon, 17 Apr 2023 11:15:04 GMT [source]

Though they mentioned the advantages of a universal model, the training cost was still expensive. Meanwhile, due to the inexplicit programming of the deep learning algorithm, it is unclear that if there are useless features contaminated when feeding the data into the model. Authors found out that it would have been better if they performed feature selection part before training the model and found it as an effective way to reduce the computational complexity.

Feature reduction using principal component analysis

Table4 recorded how the number of features affects the model training efficiency, then uses the stack bar chart in Fig.6 to illustrate how PCA affects training efficiency. Table6 shows accuracy and efficiency analysis on different procedures for the pre-processing of features. The times taken shown in Tables4, 6 are based on experiments conducted in a standard user machine to show the viability of our solution with limited or average resource availability. While these curves have different patterns, for the length of 2 weeks, the cross-validation score increases with the number of features selected. If the prediction term length is 1 week, the cross-validation score will decrease if selected over 8 features.

Conversely, resistance levels represent prices at which a stock has shown a tendency to fail in attempting to move higher, turning back to the downside. Low volume trading on Down Days – This is also a bullish indication since it indicates that on days when the stock’s price falls back a bit, not many investors are involved in the trading. Therefore, such down days occurring in an overall bull market are commonly interpreted as temporary retracements or corrections rather than as indicators of future significant price movement. In fact, many individual investors determine their buying and selling decisions almost solely based on following the identified actions of major institutional traders. They buy stocks when volume and price movement indicate that major institutions are buying, and sell or avoid buying stocks when there are indications of major institutional selling. That’s because trading volume is considered a critical technical indicator by nearly every stock investor.

- The normalized confusion matrix of testing the two feature sets are illustrated in Fig.5.

- Uptrend lines act as support and indicate that there is more demand than supply, even as the price rises.

- Hence, the objective has been converted to resolve a binary classification problem, meanwhile, finding an effective way to eliminate the negative effect brought by the high level of noise.

- Stock analysts attempt to determine the future activity of an instrument, sector, or market.

- Multiple r-square is also called the coefficient of determination, and it shows the strength of predictor variables explaining the variation in stock return .

- But it also helps if you have a mentor and tools that allow you to succeed.

The authors proposed a comprehensive model, which was a combination of two novel machine learning techniques in stock market analysis. Besides, the optimizer of feature selection was also applied before the data processing to improve the prediction accuracy and reduce the computational complexity of processing daily stock index data. Though they optimized the feature selection part and split the sample data into small clusters, it was already strenuous to train daily stock index data of this model. It would be difficult for this model to predict trading activities in shorter time intervals since the data volume would be increased drastically. McNally et al. in leveraged RNN and LSTM on predicting the price of Bitcoin, optimized by using the Boruta algorithm for feature engineering part, and it works similarly to the random forest classifier. Besides feature selection, they also used Bayesian optimization to select LSTM parameters.